We generalize the implications of Spencer’s words and what we are observing about American politics and society in the age of Trump into an analysis of the anti-democratic orientations of white Americans across four waves of WVS data from 1995 to 2011. We construct an argument linking social intolerance to anti-democratic orientations, highlighting how perceived outgroup threat to status and material well-being leads to an intolerance from white Americans toward the presence of ethnic/racial outgroups. This becomes a problem for attitudes about democracy since democracy requires extending the “opportunity of access” to politics to these same outgroups that aggrieved white Americans perceive as threatening them. Our analysis of four waves of WVS data finds support for our argument. White Americans who would not want an immigrant/foreign worker, someone who spoke a different language, or someone from a different race as a neighbor are more likely to support strongman rule in the United States, rule of the U.S. government by the army, and are more likely to outright reject having a democracy for the United States. These findings are robust across multiple model specifications we analyze and report in the appendix as well.

Link here.

Monday, May 28, 2018

Friday, May 25, 2018

This Is Why It's So Hard to Sound Normal When You're Nervous

Anxiety and awkwardness create a lot of mental noise and distraction, which can drain mental resources from other processes, like finding and using the correct words. “If you experience strong emotion, fear, or any negativity-based feeling, it makes it harder to figure out these words,” Tashiro says. Part of the reason is that awkward people engage in bottom-up brain processing, Tashiro says. They tend to see situations as an accumulation of details to absorb. “In top-down processing, a person goes to a party and their first thought is that the tone of the room is positive or neutral. Most people who are bottom-up [in their brain processing] are putting together the pieces and are in a rush to put it together.

Awkward people, who are self-critical and analyze environments for potential threats to their insecurities, are doing more mental work than non-awkward people capable of “joining in the sing-song of the moment,” Tashiro says. “Especially because of speed demands, it’s amazing how many cues [awkward] people are taking in,” he adds. When a person is not able to focus on speech, non-word placeholders, like “ugh” and “um” sneak in, and “Nice to meet you” becomes “Niece to feed you.

Awkward people, who are self-critical and analyze environments for potential threats to their insecurities, are doing more mental work than non-awkward people capable of “joining in the sing-song of the moment,” Tashiro says. “Especially because of speed demands, it’s amazing how many cues [awkward] people are taking in,” he adds. When a person is not able to focus on speech, non-word placeholders, like “ugh” and “um” sneak in, and “Nice to meet you” becomes “Niece to feed you.

Link here.

Saturday, May 19, 2018

Impact of the Trump Fiscal Stimulus on US Economic Growth

Together, the sweeping tax cuts enacted in the United States at the end of 2017 and the spending package enacted in February of this year are expected to add $276 billion in fiscal stimulus to the US economy this year, or 1.4 percent of GDP. But the actual impact on US economic growth may turn out to be lower than meets the eye. As we explain in this blog, the impact of fiscal stimulus on economic activity and output varies with the business cycle. Existing projections of the impact of the Trump stimulus measures—the "multiplier" effects—miss (or ignore) the fact that the US economy is operating at nearly full potential. Based on the current state of the US economy, we predict that the Trump fiscal stimulus will yield an extra boost to GDP of 0.5 percent by 2020, instead of 2.1 percent if this dimension is not taken into account.

Link here.

Link here.

Tuesday, May 15, 2018

CFR World Economic Update Past Event — May 11, 2018

No shit.

-----------------------------------------------------

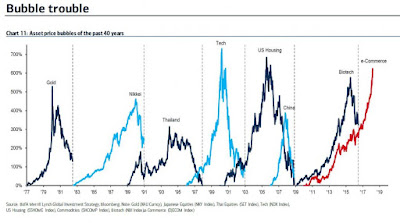

So, you know, it feels like there’s a similarity between how the economy is poised now and the dilemma for the Fed with how things were, let’s say, in 2005 or 1999. So in those cases you had inflation that was fine. You had pretty much, you know, full employment, and if there was a source of instability in 1999, it was that tech stocks were going nuts, and in 2005, the real estate thing was already beginning to pump up.

So an inflation-targeting Fed looks at this and say, our job is to target inflation, inflation seems under control. We can tighten very, very gradually. And looking back, in both cases, there was a bubble, it blew up, and the bubble blowing up caused trouble.

So why, in the face of a sudden surge of fiscal stimulus, would you not have a sudden surge of commensurate monetary tightening given that you’ve got this risk that you’ve lived through twice before, which is that if you simply target inflation—the price of eggs may be very stable, but the price of nest eggs is going nuts. Why not run policy a little tighter—which is perfectly justifiable given the credit stimulus—I mean, the fiscal stimulus—and take some of that financial sector risk off the table?

REINHART: Because it is a remarkably risk-averse entity concerned about the reaction to a marked change in its policy. If the Fed—

MALLABY: What’s the worst that could happen? Are you—we talking about the market reaction or are we talking about political reaction first of all?

REINHART: Oh, I don’t think it’s political reaction.

MALLABY: OK, so it’s the market—

REINHART: I think it’s the market reaction, that we saw the 10-year flirting with 3 percent as a risk even for emerging market economies. Think back to the taper tantrum—this is an institution scarred by that, that if there is a deep irony that before the taper tantrum they were frank in criticizing the 2004 to 2006 policy realignment as too gradual and too telegraphed. It not just made the yield curve steeper than it would be otherwise, strengthening the carry trade and adjustable rate mortgage finance. It also made them safe because it was so clear what the Fed was going to do.

MALLABY: Right, right.

REINHART: After the taper tantrum, what are they doing? They are more gradual, they’re more contractual even as they continue to say all decisions are data-dependent and made meeting by meeting.

MALLABY: So you’re suggesting that the Fed is colored by the effect of its policy on emerging markets.

REINHART: Markets—financial markets generally.

Link here.

Sunday, May 13, 2018

Sunday, May 6, 2018

Saturday, May 5, 2018

Marco Rubio says there’s “no evidence whatsoever” Republican tax cuts are helping workers

"Rubio’s right: corporations are using a lot more of the tax cut to benefit shareholders than they are to benefit workers

The $1.5 trillion GOP tax cut is a major boon to corporations. It slashed the corporate tax rate to 21 percent from 35 percent, reduced the rate on corporate income brought back to the United States from abroad to between 8 and 15.5 percent instead of 35 percent, and exempted American companies’ foreign income from US tax.

The Republican argument behind the bill is that putting billions of dollars back into the hands of big business will boost the economy, boost wages, and create jobs. But thus far, companies seem to be much more eager to put their tax savings into their shareholders’ pockets by the way of stock buybacks — as Rubio pointed out. Buybacks occur when companies repurchase shares of their own stock. That leaves remaining shareholders with a bigger chunk of the company and increases the earnings they reap per share.

A Bloomberg analysis found that about 60 percent of tax cut gains will go to shareholders, compared to 15 percent for employees. A Morgan Stanley survey found that analysts estimate 43 percent of tax cut savings will go to stock buybacks and dividends, while 13 percent will go to pay raises, bonuses, and employee benefits. Just Capital’s analysis of 121 Russell 1000 companies found that 57 percent of tax savings will go to shareholders, compared to 20 percent directed to job creation and capital investment and 6 percent to workers."

The $1.5 trillion GOP tax cut is a major boon to corporations. It slashed the corporate tax rate to 21 percent from 35 percent, reduced the rate on corporate income brought back to the United States from abroad to between 8 and 15.5 percent instead of 35 percent, and exempted American companies’ foreign income from US tax.

The Republican argument behind the bill is that putting billions of dollars back into the hands of big business will boost the economy, boost wages, and create jobs. But thus far, companies seem to be much more eager to put their tax savings into their shareholders’ pockets by the way of stock buybacks — as Rubio pointed out. Buybacks occur when companies repurchase shares of their own stock. That leaves remaining shareholders with a bigger chunk of the company and increases the earnings they reap per share.

A Bloomberg analysis found that about 60 percent of tax cut gains will go to shareholders, compared to 15 percent for employees. A Morgan Stanley survey found that analysts estimate 43 percent of tax cut savings will go to stock buybacks and dividends, while 13 percent will go to pay raises, bonuses, and employee benefits. Just Capital’s analysis of 121 Russell 1000 companies found that 57 percent of tax savings will go to shareholders, compared to 20 percent directed to job creation and capital investment and 6 percent to workers."

Link here.

Subscribe to:

Comments (Atom)